本月摘要:面對通膨惡化,聯準會政策升息壓力,加上地緣政治烏克蘭動盪使三大指數開局不利

❖Leading Economic Index (LEI) 領先經濟指數

NEW YORK, January 21, 2022…The Conference Board Leading Economic Index® (LEI) for the U.S. increased by 0.8 percent in December to 120.8 (2016 = 100), following a 0.7 percent increase in November and a 0.7 percent increase in October.

“The U.S. LEI ended 2021 on a rising trajectory, suggesting the economy will continue to expand well into the spring,” said Ataman Ozyildirim, Senior Director of Economic Research at The Conference Board. “For the first quarter, headwinds from the Omicron variant, labor shortages, and inflationary pressures—as well as the Federal Reserve’s expected interest rate hikes—may moderate economic growth. The Conference Board forecasts GDP growth for Q1 2022 to slow to a relatively healthy 2.2 percent (annualized). Still, for all of 2022, we forecast the US economy will expand by a robust 3.5 percent—well above the pre-pandemic trend growth.”

“The U.S. LEI ended 2021 on a rising trajectory, suggesting the economy will continue to expand well into the spring,” said Ataman Ozyildirim, Senior Director of Economic Research at The Conference Board. “For the first quarter, headwinds from the Omicron variant, labor shortages, and inflationary pressures—as well as the Federal Reserve’s expected interest rate hikes—may moderate economic growth. The Conference Board forecasts GDP growth for Q1 2022 to slow to a relatively healthy 2.2 percent (annualized). Still, for all of 2022, we forecast the US economy will expand by a robust 3.5 percent—well above the pre-pandemic trend growth.”

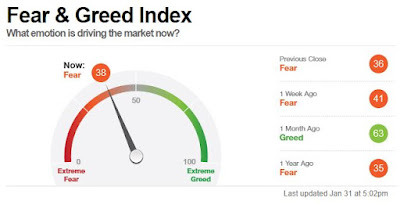

❖Fear & Greed Index 貪婪與恐懼指數 01/31

農曆春節新年快樂!時間進入2022開局第一個月,新年剛開始依然不平靜。聯準會為了遏止通膨今年或有多次升息,會使機構主力將資金抽離高估值的科技成長股,面對三大指數下跌,NASDAQ甚至跌入修正領域,對個股操作者來說難度又很高了。技術面看來線型走勢也偏空,這幾天的市場表現在低位大幅震盪,會轉守為攻或一路下殺也難講,有猴市的跡象難以捉摸,盤整期不知道會多久,而且緊接著一月財報季各公司陸續攤牌,可預期今年Q1應該依然很震,投資人的胃要撐住。今年才打第一局,高通膨環境與升息政策就已經充滿市場逆風了,之後的十一個月現在也不能硬要怎麼辦,且戰且走。

沒有留言:

張貼留言